The NEW approach to your mortgage.

At NEO Home Loans, we empower you with financial literacy and help guide your journey to financial freedom.

Schedule your dreams & goals call

Beny Rabuchin

Mortgage Advisor | Branch Leader | NMLS# 483965

Over the last 21 years, I've been fortunate to accompany over 2,700 families on their journey to real estate success. Each family is a unique story, a testament to my commitment to ensuring that no two strategies are ever the same. I'm not just interested in securing your mortgage; I'm invested in your financial health, both short-term and long-term.

My heart beats for helping my clients lay down the foundation for their financial well-being. It's not merely about securing a loan; it's about empowering you to make the best choices for your unique circumstances. I believe that every individual and family deserves a custom-crafted mortgage plan, one that fits like a glove and sets you on the path towards financial success.

In a world where mortgages often sound like a maze of numbers and jargon, I pride myself on being different. I am not just your typical Mortgage Loan Officer; I am a dedicated Mortgage Advisor. What sets me apart is my unwavering passion for guiding my clients through every step of their real estate journey, from the inception of a plan to the final payoff, and everything in between.

The NEO Experience

Being a successful homeowner is so much more than just buying a home and making your mortgage payment. The NEO Experience will make sure your home will always be a powerful tool that can help you achieve your financial goals, create generational wealth, and enjoy a secure retirement.

OUR PROCESS

Step 1

Discovery

We need to learn about you so we can understand your financial situation and long-term goals before we prescribe a mortgage strategy.

Step 2

Strategy

We will analyze mortgage options with the lowest cost and greatest prosperity potential for you and your family, then present you with a Total Cost Analysis - a digital and easy-to-read breakdown of your mortgage options.

Step 3

Execution

We create a flawless home loan experience for you. If you are in a highly competitive market, we will position you to close your loan as quickly as possible. If you need more time to prepare, we will continue to advise you on your financial situation until you are ready to buy or refinance your home.

Step 4

Wealth Maximization

Your life and the real estate market where you live can change rapidly. Even after you are in your new home, we will continue to manage your mortgage and help you maximize your wealth.

The closing of your loan is just the start of our relationship.

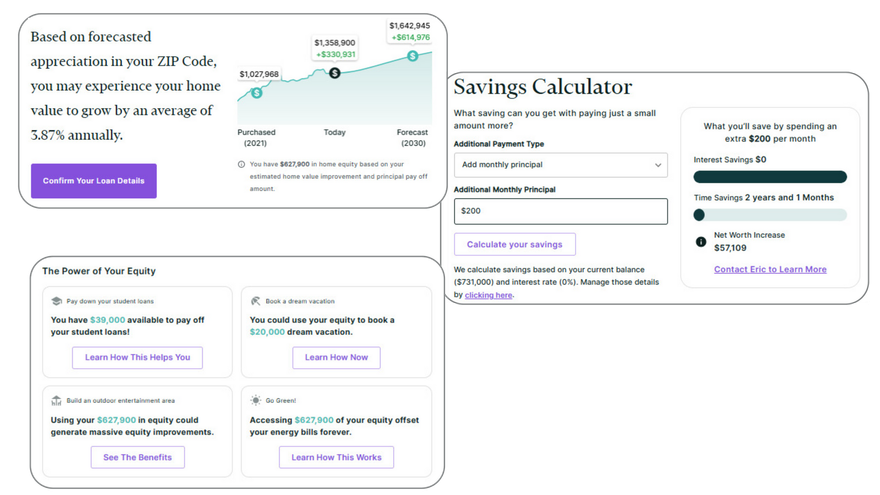

Stay informed about the value of your home!

Our monthly report offers an intuitive financial dashboard, tailored to enhance your wealth-building journey with your most significant asset: your home.

We are committed to ensuring you always have a clear and accurate understanding of your home's value and its impact on your family's financial wellbeing.